Scooter Braun Sells Taylor Swift’s Masters for ~$300 Million, Believe's Potential IPO and More

ICYMI: Publicly traded TikTok Content Houses, Hipgnosis' Annual Report 2020, and Tencent's latest investment

Welcome to Issue #2 of Appetite for Distraction, a newsletter exploring how technology is bridging the gap between art and commerce. My goal is to make this a resource that cuts through the noise; helping creators and creative industry professionals make informed decisions.

Thanks so much for subscribing, and please tell a few friends if you’d like!

— Yash

Scooter Braun Sells Taylor Swift’s Masters for ~$300 million

Scooter Braun Sells Taylor Swift’s Big Machine Masters for Big Payday | Shirley Halperin, Variety

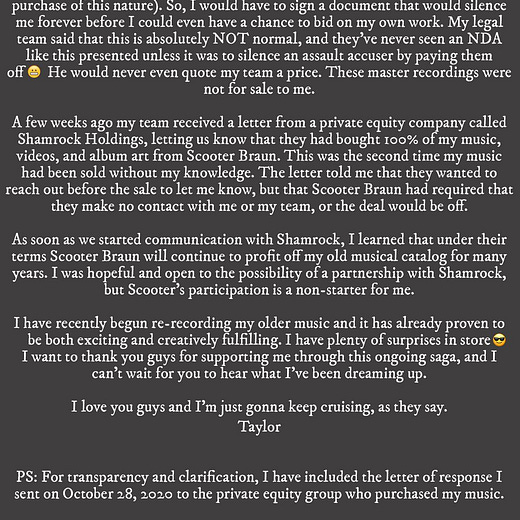

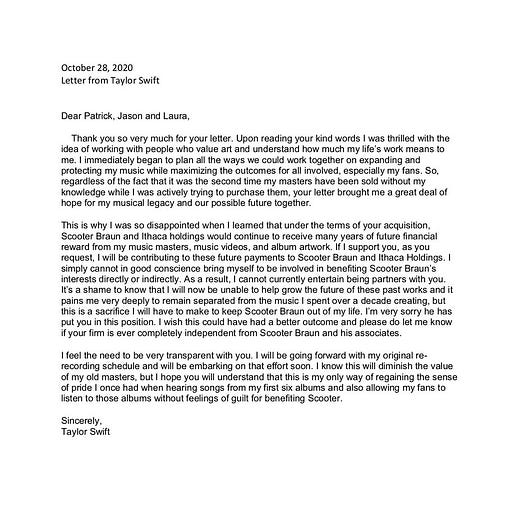

Scooter Braun, who had purchased Taylor Swift’s catalog of masters 17 months ago through his Ithaca Holdings LLC, has now sold it to Shamrock Holdings. Valuation of the masters is currently speculative, with estimates ranging from $300 to $450 million. Taylor Swift issued a message to her fans on Twitter:

The sale has refueled the age-old debate around the equity of record deals. But it’s easy to be misled by the polarizing opinions being peddled. Let’s look at some facts:

Disproving the popular trope, this isn't a case of the big bad label signing the vulnerable upcoming artist. In 2005, Scott Borchetta’s Big Machine was a cash-strapped, struggling independent label. After seeing her perform in a Nashville cafe, he signed Taylor Swift as his first artist. Fun fact: her father Scott Swift owned 3% equity in the label.

Onto the details of the contract. In return for an investment that arguably made her a global superstar, Taylor assigned her copyright to Big Machine. It restricted her from re-recording her songs for a number of years after their release. Re-recording restrictions are standard clauses in most record deals. They protect the label’s investment in producing and marketing artists and their records.

I find comparisons between IP and physical property to be surprisingly eye-opening — if one were to buy a house, renovate it and then subsequently upsell it for a profit — any belated claim made by the previous owner over how it is ‘his’ house would be immediately disregarded without second thought.

Even though she is now free to re-record these songs (which she is doing), previous attempts made by artists have been futile. Why? First — most listeners don’t care about who owns the masters when they are streaming. Second — it’s surprisingly hard to recreate the ‘vibe’ of the originally recorded master. While the newly recorded masters may attract potentially lucrative sync placements, it’s an inefficient use of time and resources.

Do artists need access to resources that decrease information asymmetries between industry folks and themselves? *Yes*. Check out: Attempts being made by companies such as CreateOS.

Having financial motivations in the music industry is often vilified (and that’s a debate for another day). But I would rather see transparent and equitable commercial structures discussed upfront instead of monetary intentions disguised as morality.

Related Read: This Record Deal Simulator Could Upend the Way Artists Do Business | Pitchfork

Believe’s Potential IPO

Indie distribution giant Believe looks headed for a $2bn-plus IPO next year | Tim Ingham, Music Business Worldwide

French distributor and label services company Believe’s potential IPO raises interesting questions around its valuation/business model.

Although they reported revenues of $700 million last year, I think Believe is in a particularly precarious position. Unlike other publicly traded music business stakeholders like Hipgnosis and Roundhill (who own long-term IP assets) or Spotify (who control direct-access to users), Believe’s hybrid record label model neither owns content, nor regulates access to it. Moreover, the label services and distribution space is a notoriously low-margin business. This is reminiscent of Kobalt's financially uncertain neo-publisher model where they sign admin deals without owning copyrights.

Believe can potentially gain access to IP by leveraging their talent at scale (Tunecore) + their acquired record labels (Naive Records, Nuclear Blast et al). But if their primary business is centered around label services and revenue share agreements, it may be a challenge to keep retail investors satisfied.

ICYMI

TikTok Mansions Are Publicly Traded Now | Taylor Lorenz, Peter Eavis, and Matt Philips, The New York Times

Clubhouse Media Group; formed after a reverse takeover between West of Hudson and Tongji Healthcare is now listed on the pink-sheets market at $2.30 a share!

West of Hudson operates a network of content houses letting influencers stay there rent-free; essentially functioning like a management agency with revenue-share agreements between them.

Hipgnosis Songs Fund Annual Report 2020 | Hipgnosis

Hipgnosis, a publicly traded royalty-fund managed by Merck Mercuriadis released its Annual Report for 2020. Though music consumption formats are in constant flux, the underlying IP is a stable long-term investment. But how does one project the value of intellectual property over time? Especially since it is inextricably tied to culture? The Hipgnosis report offers useful tools.

Spotify opens a marketplace for Canvas looping artwork designers | Brian Heater, TechCrunch

Spotify has leveraged last year’s SoundBetter acquisition to offer artists an upwork style marketplace that lets them pick designers for Canvas; an engaging alternative to album artwork. How engaging? Spotify says listeners are 145% more likely to share the song and 20% more likely to add it to their playlist.

Tencent Music invests in US 'avatar' concert company Wave | Nikki Sun, Nikkei

Tencent Music has acquired a minority stake in Wave, a company specializing in virtual ‘avatar’ concerts. The pandemic has accelerated the company’s growth; attracting funding from the likes of NTT Docomo as well as Justin Bieber, The Weeknd, Kendrick Lamar and J Balvin.

Snap acquired Voisey, an app to create music tracks overlaying your own vocals | Ingrid Lunden, TechCrunch

Snap acquired Voisey, an app that enables audio-based user generated content. Often described as the ‘TikTok for audio’ Voisey lowers the barriers to music creation.

Bandcamp adds ticketed live streams for virtual concerts | Ian Carlos Campbell, The Verge

Bandcamp recently launched ticketed livestreams called Bandcamp Live. Artists can set ticket prices, send notifications to their followers and also offer a virtual merch table. But they still need an open broadcast software (OBS) to use Bandcamp Live; which may prove to be technically challenging for some artists.

Ticketing firm Eventbrite buys marketing platform ToneDen | Stuart Dredge, MusicAlly

Eventbrite acquired ToneDen to help creators attract and grow audiences. Their ticketing infrastructure paired with ToneDen’s self-serve marketing tools is a perfect strategic integration.

YouTube’s Bet on Music Will ‘Narrow the Gap’ in Audio Ads | Scott Nover, AdWeek

YouTube is beta testing dynamic audio placements which will let brands advertise through specific genre-based as well as chart-based playlists. YouTube’s pitch to advertisers highlights that music video consumption on the platform is active, rather than passive; which is potent for ad placements.

What I’m Reading

“Emily in Paris” and the Rise of Ambient TV | Kyle Chayka, The New Yorker

I wish I could dissect technology and culture as eloquently as Kyle Chayka. His essay for the New Yorker reminds me of Neil Postman’s quote: “People will come to adore the technologies that undo their capacities to think.”

What I’m Listening To

I'd love to get some feedback on your experience reading the newsletter. It'll really help me focus on what you'd like to see more of, and what would be best left out.

If You’ve Made It This Far..

You can make it all the way.

What I’m Brewing — Colombian AA+ from Gigi World Coffee

Also check out the Wall Street Journal’s piece detailing Dunkin’ and Starbucks push to get customers back into cafes.

Thank you so much for reading! If you want to get in touch, you can respond directly to this email or reach out on Twitter or LinkedIn. Always excited to meet like-minded humans!

Until next week,

— Yash